For Q3 2015, the Grupa Azoty Group reported revenue of PLN 2.4bn (versus PLN 2.3bn in Q3 2014), with net profit of PLN 82m (compared with PLN 9m in Q3 2014). EBITDA also improved year on year, having increased by PLN 95m, to PLN 223m, from PLN 128m in Q3 2014.

“In Q3 2015, the Grupa Azoty Group continued on a path of improving its EBITDA margin, which grew by more than 50% year on year, to 9% (vs 6% in Q3 2014). The Fertilizer segment remained the key growth driver, as its performance benefited from favourable trends on the raw materials market. The performance of the other segments was comparable to that reported in Q3 2014,” said Andrzej Skolmowski, Vice-President of the Management Board for Finance.

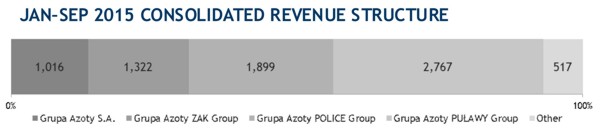

YTD sales for the first nine months of 2015 rose by 2% to PLN 7.5bn (increase of PLN 179m y/y), and net profit grew by PLN 290m y/y (up 116%) to PLN 540m. After the first three quarters of 2015, the Grupa Azoty Group also reported robust YTD EBITDA of PLN 1bn, an impressive improvement in operating profit, which grew by more than PLN 344m (up 117% y/y) to PLN 639m, and a much stronger margin of 8.5% (vs 4% in Q1−Q3 2014).

Of the key business segments, Fertilizers was the one to generate the highest margin growths at all levels of the income statement. This was mainly an effect of lower prices of key energy carriers (natural gas, coal) and of the Grupa Azoty Group successfully pursuing its trading and marketing policy. This allowed us to mitigate the adverse effect of price pressures in nitrogen fertilizers (mainly urea and ammonium nitrate), due to higher imports of these products and lower demand for ammonium sulfate in South America. With wider sales margins on nitrogen and NPK fertilizers, backed by favourable currency exchange rates (especially USD/PLN) and appropriate product allocation on the market, we were able to generate higher sales volumes already in the first months of the new fertilizer season. It is also for these reasons that revenue on Fertilizers rose by 21% y/y (almost PLN 260m by value), the segment’s EBITDA margin went up to 12% (from 6% in Q3 2014) and the overall liquidity position of the Group was markedly improved.

In the Plastics segment, consolidated EBITDA margin remained broadly flat (-2%) year on year. Higher benzene-polyamide delta, coupled with lower product sales by value, drove EBITDA margin on engineering plastics up, to 5% (compared with 3% last year). But unfavourable trends in the caprolactam market (such as the softening of demand in China caused by a slowdown in the country’s GDP growth) led to significant sales volume erosion (down by over 30%), which swallowed up the rise in earnings delivered by the segment of highly-processed products. The segment closed the third quarter with a result of PLN (-) 6.5m on revenue of PLN 292m.

The Chemicals segment posted EBITDA of PLN 18.7m, with EBITDA margin at 3%, a level similar to that reported in the same period last year. Sales were down by almost PLN 70m mainly as a result of challenges faced by the OXO and pigments business. Lower OXO alcohols output in Q3 2015, caused by a combination of underlying supply/demand factors and unfavourable price situation in the plasticizers segment, pushed OXO margins down by almost 7%. A market environment exerting strong price pressure on the titanium white (pigments) business led to the segment’s posting lower sales volumes and lower EBITDA margin (down by almost 8%). Positive trends in export sales of sulfur and melamine, benefiting from favourable gas price trends and improved market conditions, helped the Chemicals business deliver an aggregate result similar to the figure posted in Q3 2014.

Grupa Azoty Puławy Group’s consolidated resultsIn Q3 2015, Grupa Azoty Puławy earned a net profit of PLN 65m (PLN 3m in Q3 2014), on revenue of PLN 935m (vs PLN 846m in Q3 2014).

Grupa Azoty Police Group’s consolidated results In Q3 2015, Grupa Azoty Police earned a net profit of PLN 15m (PLN 6m in Q3 2014), on revenue of PLN 600m (vs PLN 505m in Q3 2014).

Grupa Azoty Zakłady Azotowe Kędzierzyn’s separate results

On a separate basis, Grupa Azoty ZAK earned a net profit of PLN 14m in Q3 2015 (PLN 9m in Q3 2014), on revenue of PLN 435m (PLN 491m in Q3 2014).

More informations: